FirstBank Celebrates Major Milestone, Exceeds Capital Requirements Ahead of Schedule

In an impressive display of financial strength and investor confidence, FirstBank has successfully raised N500 billion in new capital, surpassing regulatory requirements well before the deadline. This achievement positions the bank to expand services, drive innovation, and support Nigeria's economic growth.

FirstBank is celebrating a remarkable achievement that showcases the strength and promise of Nigeria's banking sector. First HoldCo Plc has announced that its commercial banking subsidiary, First Bank of Nigeria, has successfully met and exceeded the Central Bank of Nigeria's ambitious N500 billion minimum capital requirement—and done so well ahead of the regulatory deadline.

This outstanding milestone represents more than just numbers on a balance sheet. It's a powerful vote of confidence from investors who believe in FirstBank's vision and Nigeria's economic future. The capital raise was completed through a strategic combination of initiatives, including an oversubscribed Rights Issue, a successful Private Placement, and proceeds from the strategic divestment of the group's merchant banking subsidiary.

The enthusiasm from investors has been nothing short of inspiring. The Rights Issue was oversubscribed, demonstrating that shareholders see tremendous value in FirstBank's long-term strategy and growth potential. This level of support speaks volumes about the bank's reputation and the trust it has built over its many years of service to Nigerians.

What makes this achievement even more exciting is what it means for everyday Nigerians and the country's economic landscape. With this fortified capital base, FirstBank is now uniquely positioned to accelerate its support for the real sector—the backbone of Nigeria's economy. The bank has committed to enhancing financial inclusion, ensuring that more Nigerians have access to the banking services they need to build better lives and successful businesses.

Innovation is at the heart of FirstBank's vision moving forward. The strengthened capital position will enable the bank to deliver cutting-edge, digitally driven customer experiences that make banking more accessible, efficient, and user-friendly. In today's fast-paced world, this commitment to technological advancement will benefit millions of customers across the nation.

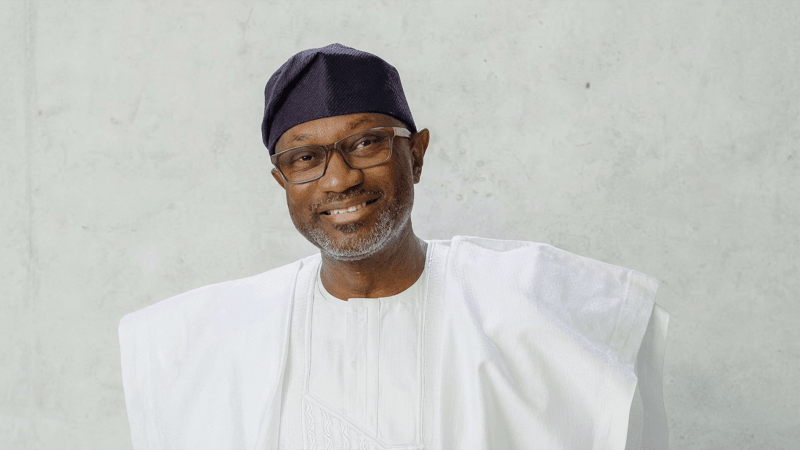

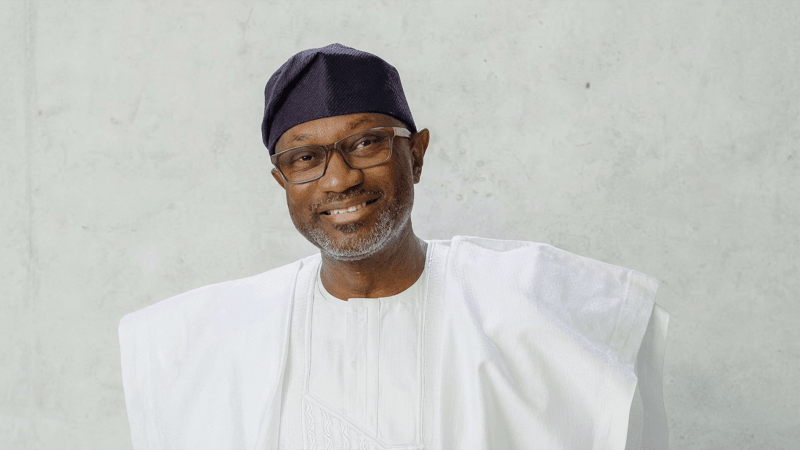

Billionaire investor and Chairman of First HoldCo Plc, Femi Otedola, expressed heartfelt gratitude to shareholders for their "trust and unwavering support" throughout the capitalisation programme. His words reflect the collaborative spirit that made this success possible, noting that investors have "demonstrated resounding confidence in our strategic direction."

Looking ahead, FirstBank's ambitions extend even further. The bank has announced plans to raise additional funding in 2026 to inject capital into existing subsidiaries and explore new business opportunities. This forward-thinking approach signals continued growth and innovation on the horizon.

Wale Oyedeji, Group Managing Director of First HoldCo, described the capital raise as "a pivotal milestone" that provides the financial strength to drive innovation, deliver superior customer value, and enhance sustainable profitability. His vision focuses on "accelerating performance, improving competitive returns and delivering lasting value to all our stakeholders."

The context makes this achievement even more impressive. When the Central Bank of Nigeria issued its directive in March 2024, requiring commercial banks to raise their capital base to N500 billion within 24 months, it set an ambitious target designed to bolster the entire banking sector's stability and capacity. FirstBank's early completion of this requirement sets a positive example for the industry and demonstrates the bank's operational excellence.

This success story is ultimately about building a stronger, more inclusive financial future for Nigeria—one where innovation thrives, businesses grow, and every Nigerian has the opportunity to participate in economic prosperity.

Based on reporting by Guardian Nigeria

This story was written by BrightWire based on verified news reports.

Spread the positivity! 🌟

Share this good news with someone who needs it

More Good News

✨ Daily Mix

✨ Daily MixHow Better Flight Connections Are Bringing Cities and Businesses Closer Together

✨ Daily Mix

✨ Daily MixGerman Families Achieve Remarkable €10 Trillion Savings Milestone Through Smart Planning

✨ Daily Mix

✨ Daily MixWall Street Celebrates New Records as Tech Innovation Powers Global Markets Forward

Joke of the Day

Why did the librarian get kicked out of class?

Explore Categories

Quote of the Day

"Do not go where the path may lead, go instead where there is no path and leave a trail."

— Ralph Waldo Emerson